Focusing on what you can control and ignoring ‘noise’ leads to a better investment experience, no question about it. Whether you’ve been investing for decades or are just getting started, at some point on your investment journey you will probably ask yourself some of the questions below.

This is not an exhaustive list, but it will shed light on some key principles that may help improve your odds of investment success in the long run.

1. What sort of competition do I face as an investor?

The ‘market’ is an effective information-processing machine. Every day, millions of market participants buy and sell shares in The Good Companies of The World and the real-time information they bring helps set prices. The same is true of “bonds” issued by the same companies and governments.

This means competition is stiff and trying to outguess market prices is difficult even for professional money managers (see question 2 for more on this). This is good news for you though. Rather than basing an investment strategy on trying to find securities that are priced “incorrectly,” you can instead rely on the information in market prices to help build your portfolios (see question 5 for more on this).

* Year-end WM/Reuter’s London Close FX rates used to convert original US dollars data to British pound sterling. Source: World Federation of Exchanges members, affiliates, correspondents, and non-members. Trade data from the global electronic order book. Daily averages were computed using year-to-date totals as of December 31, 2016, divided by 250 as an approximate number of annual trading days.

2. What are my chances of picking an investment fund that survives and outperforms?

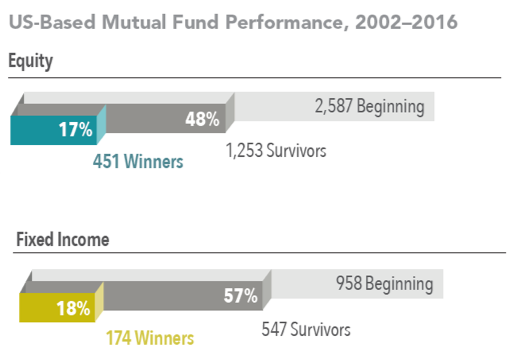

Pull out a coin from your pocket. Heads or tails? Your odds flipping a heads or tails are 50/50. Historically, the odds of selecting an investment fund that was still around 15 years later are about the same as that coin flip. A two-person retirement can be three decades, so this is important. Regarding outperformance, the odds are worse. The market’s pricing power works against fund managers who try to outperform through stock picking or market timing. One needn’t look further than real-world results to see this. For example, based on research, only 17% of US equity mutual funds and 18% of US fixed income mutual funds have survived and outperformed their benchmarks over 15 years.

Source: Mutual Fund Landscape 2017, Dimensional Fund Advisors. See Appendix for important details on the study. Past performance is no guarantee of future results.

3. If I choose a fund because of strong past performance, does that mean it will do well in the future?

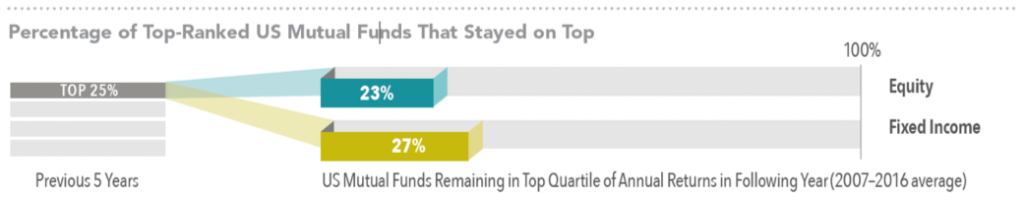

Some investors select investment funds based on past returns. However, research shows that most funds in the top quartile (25%) of previous five-year returns did not maintain a top-quartile ranking in the following year. In other words, past performance offers little insight into a fund’s future returns.

Source: Mutual Fund Landscape 2017, Dimensional Fund Advisors. See Appendix for important details on the study. Past performance is no guarantee of future results.

4. Do I have to outsmart or time the market to be a successful investor?

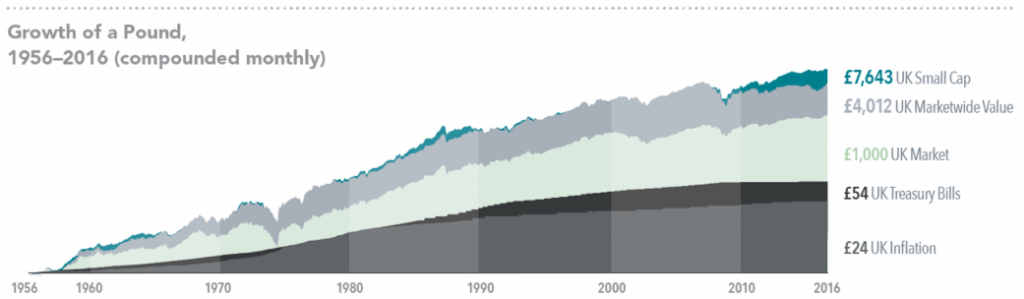

You will need to make two timing decisions accurately; when to get out and when to get back in. Market cycles and economic cycles do not line up. This means your timing decisions will be wrong not once, but twice. Keep doing this, and you will blow up your investment portfolio. Just as well you don’t need to. Financial markets have rewarded long-term investors. People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. Instead of fighting markets, let them work for you.

In British pound sterling. UK Small Cap is the Dimensional UK Small Cap Index. UK Marketwide Value is the Dimensional UK Marketwide Value Index. UK Market is the Dimensional UK Market Index. UK Treasury Bills are UK One-Month Treasury Bills. UK Inflation is the UK Retail Price Index. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. See appendix for index descriptions. Past performance is no guarantee of future results. The graph is for illustrative purposes only, figures presented are hypothetical and not indicative of any investment.

5. Is there a better way to build a portfolio?

Of course. Academic research has identified four equity and two fixed income dimensions which point to differences in expected returns. Instead of attempting to outguess market prices, with the help of your financial planner, you can instead pursue higher expected returns by structuring your portfolio around these dimensions at low cost.

Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortisation minus interest expense scaled by book.

6. Is international or worldwide investing for me?

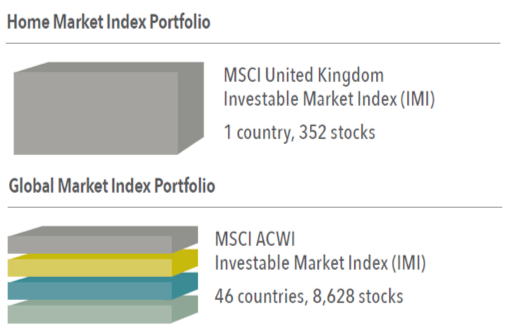

Diversification helps reduce risks that have no expected return, but diversifying only within your home market may not be enough. Instead, global diversification can broaden your investment opportunity set. By holding a globally diversified portfolio, you are well positioned to seek returns wherever they occur.

Number of holdings and countries for MSCI United Kingdom Investable Market Index (IMI) and MSCI ACWI (All Country World Index) Investable Market Index (IMI) as at 31 December 2016. MSCI data © MSCI 2017, all rights reserved. Indices are not available for direct investment. International investing involves special risks such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Diversification neither assures a profit nor guarantees against loss in a declining market.

7. Will making frequent changes to my portfolio, help me achieve investment success?

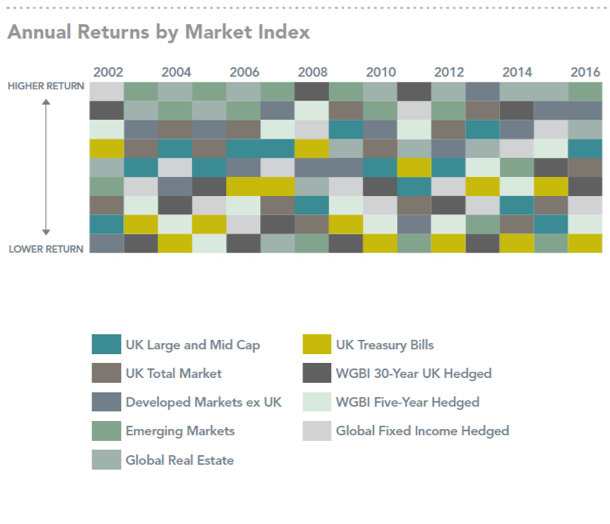

It’s tough, if not impossible, to know which market segments will outperform from period to period. Accordingly, it’s better to avoid market timing calls and other unnecessary changes that can be costly. Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results (an understatement).

In British pound sterling. UK Large and Mid Cap is the MSCI United Kingdom Index (gross dividends). UK Total Market is the MSCI United Kingdom IMI Index (gross dividends). Developed Markets ex UK is the MSCI World ex UK Index (gross dividends). Emerging Markets is the MSCI Emerging Markets Index (gross dividends). Global Real Estate is the S&P Global REIT Index (gross dividends). UK Treasury Bills are UK One-Month Treasury Bills. WGBI 30-Year UK Hedged is the Citi World Government Bond Index UK 1–30+ years (hedged to GBP). WGBI Five-Year Hedged is Citi World Government Bond Index 1–5 Years (hedged to GBP). Global Fixed Income Hedged is Bloomberg Barclays Global Aggregate Bond Index (hedged to GBP). MSCI data © MSCI 2017, all rights reserved. S&P data provided by Standard & Poor’s Index Services Group. Prior to 1975: UK Three-Month Treasury Bills provided by the London Share Price Database; 1975–present: UK One-Month Treasury Bills provided by the Financial Times. Citi fixed income indices © 2017 by Citigroup. Data provided by Bloomberg. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.

8. Should I make changes to my portfolio based on what I’m hearing in the news?

Daily market news and commentary can challenge your investment discipline. Some messages are designed to stir anxiety about the future, while others tempt you to chase the latest investment fad. If headlines are unsettling, consider the source and the motive for them and try to maintain a long-term perspective.

9. So, what should I be doing?

Work closely with a financial planner who you trust implicitly, who shares an evidence-based investment philosophy and believes that the rightful place of an investment strategy over a three-decade retirement is in the service of a personal financial plan (or at least a written investment policy statement and simple retirement income plan).

A financial planner with this focus will see you as their client (not your money) and offer expertise and guidance to help you pay attention to actions that add value. Focusing on what you can control can lead to a better investment experience by:

- Creating an investment plan to achieve your purpose led goals and fit your risk tolerance.

- Structuring a portfolio along the dimensions of expected returns.

- Diversifying globally.

- Managing expenses, turnover, and taxes.

- Helping you staying disciplined through market dips and swings so you receive the returns available to you.

If you have any questions, our door is open – its why we were sent into the world. Just give us a call, drop an email or pop in.

Until the next time, let me leave you with this quotation:

“The money we manage is not our money – it’s our clients’ past and their future.” – Eduardo Repetto.

Kind Regards

Andrew Stinchcomb

Lead Navigator

Certified Financial Planner™ professional

Chartered Wealth Manager™

Investors should remember that the value of investments, and the income from them, can go down as well as up. This update has been produced for information purposes only and isn’t intended to constitute financial advice; investments referred to may not be suitable for everyone.